Introduction

The lack of information about how to get started in a market that is especially unforgiving to both novice and experienced traders is one of the biggest obstacles for new forex traders. Below find out the Forex Trading Tips.

When it comes to taking a position in the world’s most liquid trading market, having a trading plan is an essential component of any trader’s toolbox. Before making your toolkit, we’ve put together some forex trading advice for you to consider.

Begin small

Many novice traders make the mistake of jumping right in, but you shouldn’t enter a trade until it has been well thought out. Whenever you do, begin little – R200 a point at the extremely most, and gradually fabricate your certainty. In trading, there is no such thing as beginner’s luck; at the point when you start, you will lose cash on certain exchanges and bring in cash on others.

Because of this, it makes sense to make mistakes early on and minimize their costs. On the off chance that you start at £10 a point and the market conflicts with you by 25, you will be somewhere near R1500 straight away, also the resulting loss of certainty. That is a costly lesson, especially when you consider that entering a trade does not guarantee that the market will immediately move in your favor.

Choose a suitable currency pair

Consider your level of comfort with the forex market’s level of volatility. Would you like to attempt to make a momentary increase, or could you like to search for a steady benefit gathered over the long run? If you’re looking for short-term gains, you’ll probably find markets that are quite active and have a large daily range in comparison to the spread between prices. A reasonable amount of liquidity is also equated to a tight bid/offer spread, which is advantageous in the event that things go against you because fast-moving markets provide a greater opportunity to close a position.

Take a look at our selection of instruments, which include significant currency pairs like EUR/USD, GBP/USD, and EUR/GBP.

Make it easy.

Avoiding overcomplicating your analysis with a variety of technical trading indicators can be prudent because they can occasionally provide contradictory signals and clog your mind. The fundamental essential questions you ought to ask yourself are: a) Do you see a pattern? yes/no); b) If the trend is sideways, do nothing, if the trend is upward, look to buy, and if the trend is downward, look to sell; d) look for areas of support and resistance before deciding whether to trade.

Define your goals.

Trading in line with the trend is one of the most important rules: Place a “buy” trade if the market is going up; and in the event that it is declining, enter a “sell” trade. Attempting to select the base or top is probably not a good idea. If the market is going up, you should decide where you want to buy and place your trade there. If you want to sell, you should do the same thing. You should have a risk management plan with predetermined levels for your stop-loss and take-profit. Last but not least, you shouldn’t trade just for the sake of trading; being neutral is also a position.

Control your finances

An important part of a trader’s overall profitability is good money management. Taking a profit as soon as you see one can cause many people to lose money. This may be due to the fact that traders rarely execute profit-making stop-loss orders as they do with stop-loss orders. It is unlikely that you will make a profit overall if you operate on the 50/50 principle, which states that you profit on fifty percent of the trades that are executed.

Think about how much money you are willing to lose before making a trade. On the off chance that it’s R300, you ought to intend to make no less than R600 benefit. You would be making a profit overall in this way, assuming a success rate of fifty percent. For each component of chance, you ought to be hoping to make no less than twofold that on the benefit side. Discipline is essential both when things are going well and when they are not.

Know your own insights

By keeping track of all of your transactions, you can figure out where you’ve been making profits and losing money. By keeping track of your trading history’s performance, you can identify patterns in your successes and failures so that you can eliminate the less profitable trades and increase the profitable ones.

Assess the past

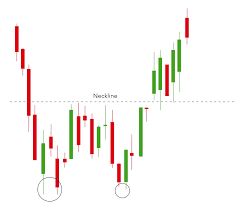

The Dow theory is based on the idea that “history repeats itself.” This is one of the fundamental tenets of the technical approach. Viewing at past cost activity on a resource can give hints with respect to how the cost will act from here on out, in light of past experience. Given a particular set of circumstances, human behavior can be somewhat predictable, and this is how the technical approach can work. Price is influenced by people like you and me who succumb to the same human emotions of hope, greed, and fear as everyone else. Market forces determine price. It is possible for traders to develop a variety of strategies by using “what if” scenarios by looking at where previous highs and lows have occurred and how the market has behaved at these levels in the past.

Thats it for this Edition of Forex Trading Tips: Basics. Always remember to Trade Responsibly guys.